BY GEORGE HAY

Are global equities cheap yet? After two sharp corrections in February and October 2018, investors will be running their rules over stock-market valuations. They should be wary of falling victim to a value trap.

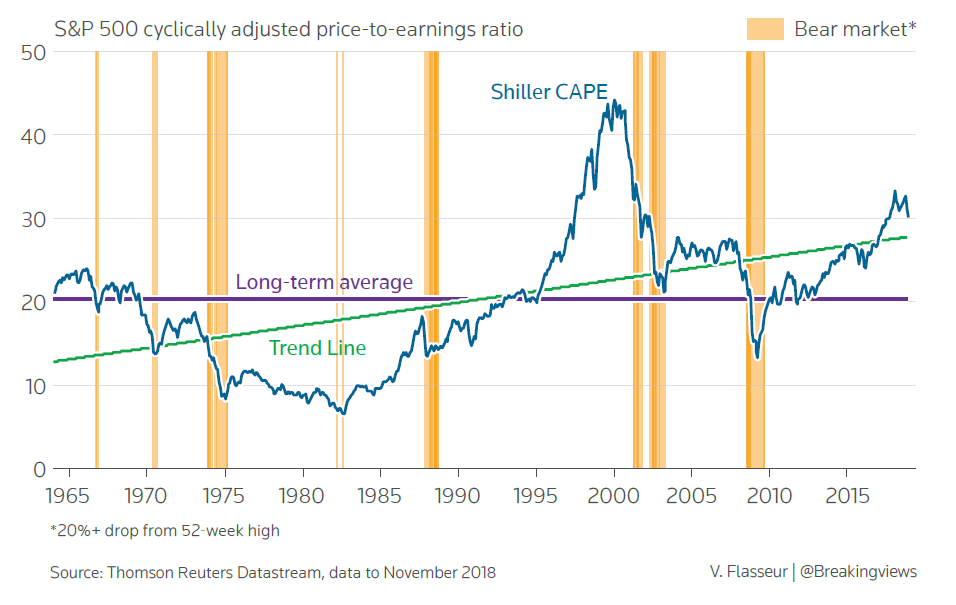

On one measure, U.S. equities still look eye-wateringly overpriced. Economist Robert Shiller’s cyclically adjusted price-to-earnings ratio, or CAPE, which smooths the S&P 500 Index PE ratio over the prior 10 years, is running above 30 times based on data for November 2018. That’s in line with where it stood 90 years ago as the Wall Street Crash commenced, and second only to the 40-odd multiple seen in 1999 to 2000 during the dot-com era.

That’s not the whole story, though. After declines in 2018, U.S. equities in the Russell 1000 trade at 15.4 times next year’s estimated earnings, roughly in line with their 10-year average, according to FTSE Russell as of early December. And the CAPE picture looks more reasonable applying the upward-sloping trend line since World War Two. Assuming reversion to that trend, S&P 500 earnings per share would only need to increase 10 percent in 2019 for the market to grow into its current valuation, FTSE Russell reckons.

That’s less than half the 24 percent profit growth U.S. companies are on track for in 2018, albeit with a boost from tax cuts, according to Refinitiv data. As of early December, analysts are forecasting S&P 500 earnings expansion of 8.4 percent in 2019. The danger, though, is that at this stage of the cycle they are routinely too optimistic. Revenue, which turns into earnings, usually lags nominal GDP — where growth could slow in 2019. Leading indicators like the U.S. ISM Manufacturing Index may be peaking, too.

What about everywhere else? Forward earnings multiples in Europe and emerging markets are also in line with 10-year averages, and their discounts to U.S. stock prices remain in place. Emerging markets are relatively more heavily exposed to banks and big technology groups, and they tend to suffer an outsized response when the U.S. lurches down — a risk given the hoariness of the U.S. economic recovery, uncertainty over interest rates and trade tensions.

In fact, only in the UK and Japan do stocks look relatively cheap on an expected earnings multiple basis, but they come with extra layers of cloud covering the outlook. In 2019 there could be plenty of falling knives, and a dearth of safe bets.

First published Dec. 11, 2018.